In this age of technology, in which screens are the norm however, the attraction of tangible printed materials isn't diminishing. No matter whether it's for educational uses such as creative projects or simply adding an extra personal touch to your area, Are Donations To A Foundation Tax Deductible are now a vital resource. With this guide, you'll dive through the vast world of "Are Donations To A Foundation Tax Deductible," exploring the different types of printables, where they can be found, and how they can add value to various aspects of your lives.

Get Latest Are Donations To A Foundation Tax Deductible Below

Are Donations To A Foundation Tax Deductible

Are Donations To A Foundation Tax Deductible -

Charitable contributions to a private foundation are eligible for a tax deduction of up to 30 of the donor s adjusted gross income AGI So for example if a donor with an AGI of 1 million contributes 250 000 to their private

Also contributions to private oper ating foundations described in Internal Revenue Code section 4942 j 3 are deductible by the donors to the extent of 50 percent of the donor s adjusted

Are Donations To A Foundation Tax Deductible offer a wide collection of printable material that is available online at no cost. These printables come in different types, like worksheets, coloring pages, templates and many more. The benefit of Are Donations To A Foundation Tax Deductible is their flexibility and accessibility.

More of Are Donations To A Foundation Tax Deductible

How Much Do You Need To Donate For Tax Deduction

How Much Do You Need To Donate For Tax Deduction

Contributions to public charities and private foundations are both tax deductible However public charities have higher tax deductible giving limits and are more likely to allow for a fair market value deduction rather than tax

You must make contributions to a qualified tax exempt organization You must have documentation for cash donations of more than 250 You must have written appraisals for

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Customization: There is the possibility of tailoring printed materials to meet your requirements when it comes to designing invitations, organizing your schedule, or even decorating your home.

-

Educational Worth: Printing educational materials for no cost cater to learners of all ages, making them a vital resource for educators and parents.

-

Easy to use: You have instant access an array of designs and templates helps save time and effort.

Where to Find more Are Donations To A Foundation Tax Deductible

The Average American s Charitable Donations How Do You Compare The

The Average American s Charitable Donations How Do You Compare The

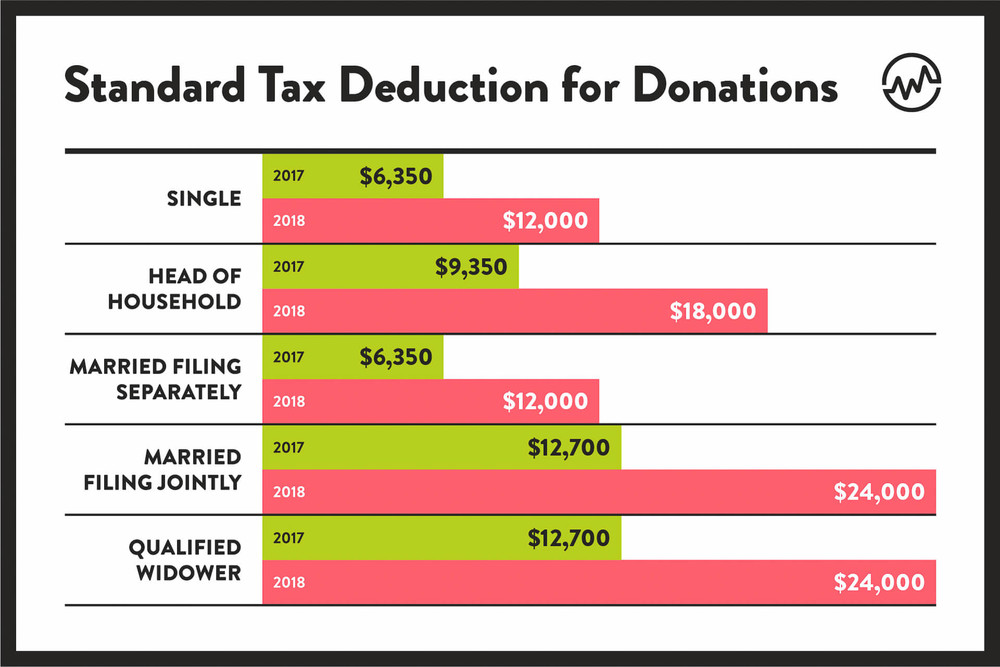

Charitable contributions to an IRS qualified 501 c 3 public charity can only reduce your tax bill if you choose to itemize your taxes Generally you d itemize when the combined total of

Taxpayers may deduct charitable donations of up to 60 of their adjusted gross incomes Charitable donations to individuals no matter how worthy are not deductible Rules for Charitable

If we've already piqued your curiosity about Are Donations To A Foundation Tax Deductible We'll take a look around to see where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Are Donations To A Foundation Tax Deductible to suit a variety of reasons.

- Explore categories like decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets along with flashcards, as well as other learning tools.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- The blogs covered cover a wide selection of subjects, everything from DIY projects to party planning.

Maximizing Are Donations To A Foundation Tax Deductible

Here are some unique ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets for free to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Are Donations To A Foundation Tax Deductible are a treasure trove of fun and practical tools that meet a variety of needs and interests. Their accessibility and flexibility make these printables a useful addition to both professional and personal life. Explore the world of Are Donations To A Foundation Tax Deductible today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I utilize free printables in commercial projects?

- It's all dependent on the usage guidelines. Always consult the author's guidelines before using printables for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables might have limitations on usage. Make sure you read the terms of service and conditions provided by the author.

-

How can I print printables for free?

- Print them at home with either a printer at home or in an area print shop for more high-quality prints.

-

What program do I need to run printables for free?

- The majority of printables are in the format of PDF, which is open with no cost software such as Adobe Reader.

BTMAD2019 TheMatthewShepardFoundation 196 Matthew Shepard Foundation

Mequon Police Department K9 Unit Mequon Wisconsin

Check more sample of Are Donations To A Foundation Tax Deductible below

Donation Government Grants News Startgrants

Explainer Why Are Donations To Some Charities Tax deductible

Support Us With Tax Deductible Donations By Purple Playas Foundation In

Fit Kidz Foundation Tax deductible Donation Request

Support The Maryland Sierra Club Sierra Club

5 Reasons To Make Tax Deductible Donations Arizona Friends Of Foster

https://www.irs.gov › ... › private-operating-foundations

Also contributions to private oper ating foundations described in Internal Revenue Code section 4942 j 3 are deductible by the donors to the extent of 50 percent of the donor s adjusted

https://www.irs.gov › publications

Because the total of your cash contribution of 2 000 and your capital gain property of 28 000 to a 50 limit organization 30 000 is more than 25 000 50 of 50 000 your contribution to

Also contributions to private oper ating foundations described in Internal Revenue Code section 4942 j 3 are deductible by the donors to the extent of 50 percent of the donor s adjusted

Because the total of your cash contribution of 2 000 and your capital gain property of 28 000 to a 50 limit organization 30 000 is more than 25 000 50 of 50 000 your contribution to

Fit Kidz Foundation Tax deductible Donation Request

Explainer Why Are Donations To Some Charities Tax deductible

Support The Maryland Sierra Club Sierra Club

5 Reasons To Make Tax Deductible Donations Arizona Friends Of Foster

How To Maximize Your Charity Tax Deductible Donation WealthFit

Printable Donation Receipt

Printable Donation Receipt

Printable 501C3 Donation Receipt Template