In this age of technology, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons and creative work, or simply to add the personal touch to your area, Are Contributions To A Charitable Remainder Trust Tax Deductible have proven to be a valuable source. This article will dive deep into the realm of "Are Contributions To A Charitable Remainder Trust Tax Deductible," exploring what they are, where you can find them, and how they can add value to various aspects of your lives.

Get Latest Are Contributions To A Charitable Remainder Trust Tax Deductible Below

Are Contributions To A Charitable Remainder Trust Tax Deductible

Are Contributions To A Charitable Remainder Trust Tax Deductible -

For 2018 to 2025 the limit is increased to 60 for charitable contributions of cash to public charities Deductions are available for the tax years in which contributions are made and any

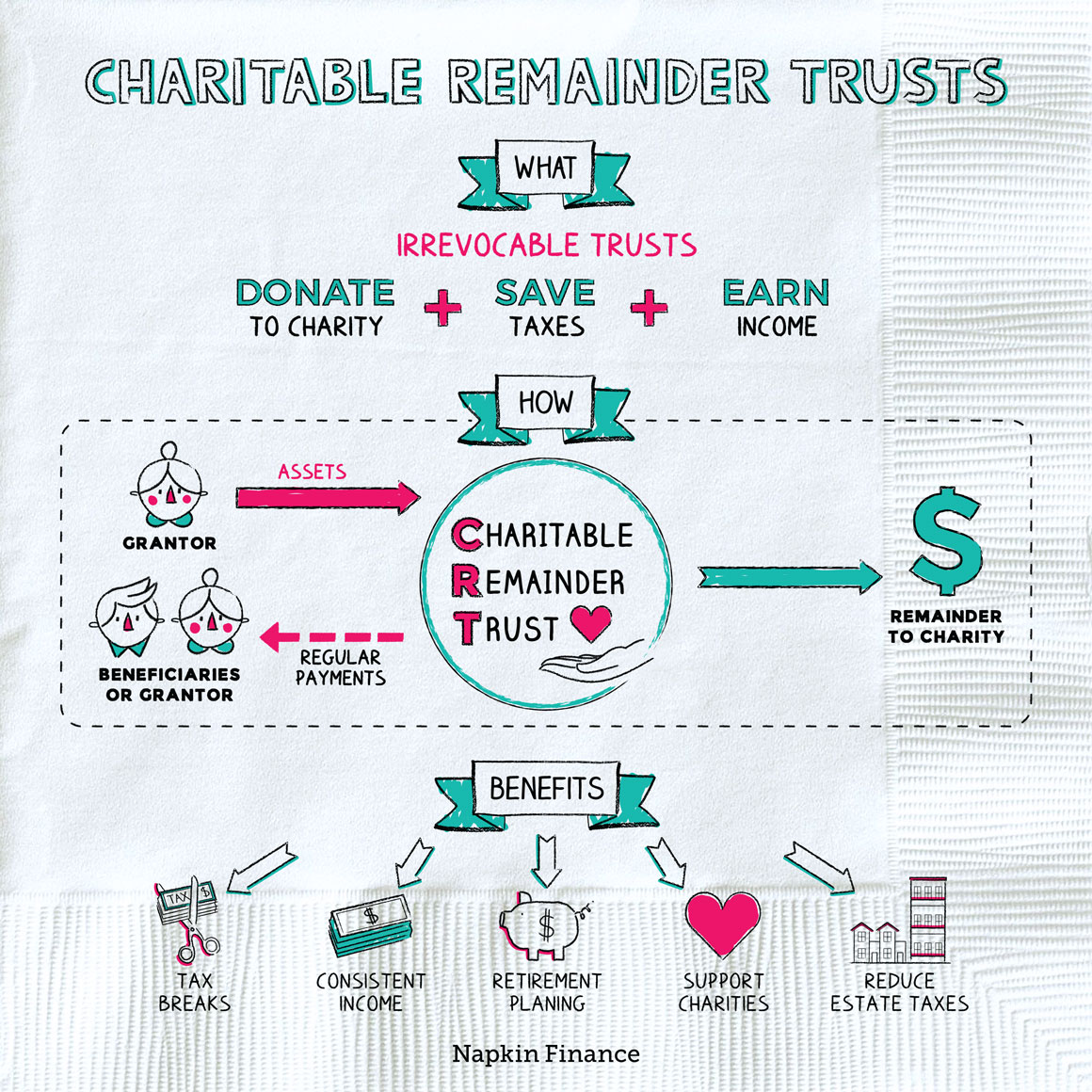

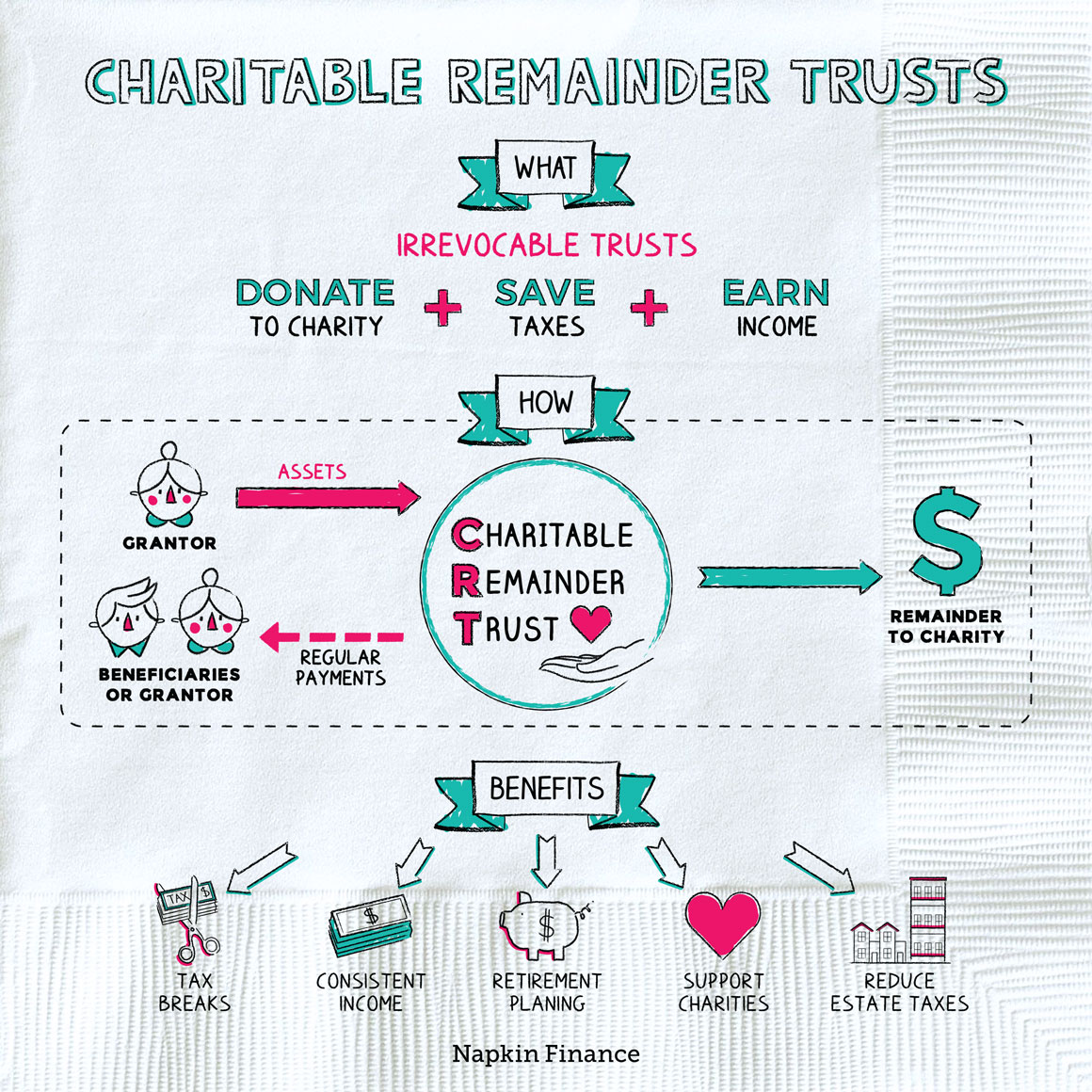

For philanthropically minded investors hoping to minimize taxes a charitable remainder trust CRT allows donors a k a grantors to make a tax deductible gift to charity while also generating income for themselves or their

Are Contributions To A Charitable Remainder Trust Tax Deductible encompass a wide selection of printable and downloadable materials available online at no cost. These resources come in various forms, including worksheets, templates, coloring pages, and more. One of the advantages of Are Contributions To A Charitable Remainder Trust Tax Deductible is their flexibility and accessibility.

More of Are Contributions To A Charitable Remainder Trust Tax Deductible

Tax Savings With A Charitable Remainder Trust Tax Hive

Tax Savings With A Charitable Remainder Trust Tax Hive

When you put assets into a Charitable Remainder Trust you re entitled to an immediate tax deduction worth at least 10 of the value of the assets And although the up front tax deduction isn t the most significant

When you fund a charitable remainder trust you will receive a charitable income tax deduction for a portion of the funding amount typically 30 to 40 of the amount you transfer How Do

Are Contributions To A Charitable Remainder Trust Tax Deductible have garnered immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

customization: The Customization feature lets you tailor printables to fit your particular needs, whether it's designing invitations or arranging your schedule or decorating your home.

-

Educational Worth: The free educational worksheets cater to learners of all ages. This makes them an invaluable source for educators and parents.

-

An easy way to access HTML0: You have instant access a variety of designs and templates reduces time and effort.

Where to Find more Are Contributions To A Charitable Remainder Trust Tax Deductible

Increase Retirement Income And Slash Taxes Using A Charitable Remainder

Increase Retirement Income And Slash Taxes Using A Charitable Remainder

Charitable remainder trusts offer several benefits including tax savings income for life estate planning benefits and philanthropic impact Donors can receive an immediate income tax deduction for their charitable

While charitable remainder trusts are tax exempt entities distributions from them are generally subject to taxation Non charitable beneficiaries pay taxes on the income they

After we've peaked your curiosity about Are Contributions To A Charitable Remainder Trust Tax Deductible we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Are Contributions To A Charitable Remainder Trust Tax Deductible suitable for many goals.

- Explore categories such as decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- These blogs cover a broad selection of subjects, including DIY projects to planning a party.

Maximizing Are Contributions To A Charitable Remainder Trust Tax Deductible

Here are some unique ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to enhance learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Are Contributions To A Charitable Remainder Trust Tax Deductible are a treasure trove of useful and creative resources designed to meet a range of needs and interests. Their access and versatility makes them a valuable addition to both professional and personal life. Explore the many options of Are Contributions To A Charitable Remainder Trust Tax Deductible today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I download free printables in commercial projects?

- It's determined by the specific usage guidelines. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Are there any copyright issues when you download Are Contributions To A Charitable Remainder Trust Tax Deductible?

- Certain printables might have limitations on their use. Be sure to read the terms of service and conditions provided by the designer.

-

How do I print Are Contributions To A Charitable Remainder Trust Tax Deductible?

- Print them at home using printing equipment or visit a local print shop for high-quality prints.

-

What program will I need to access Are Contributions To A Charitable Remainder Trust Tax Deductible?

- The majority of printed documents are as PDF files, which can be opened with free software like Adobe Reader.

The Charitable Remainder Trust CRT And Crypto HTJ Tax

CRT Diagram Mortgage Info Charitable Annuity

Check more sample of Are Contributions To A Charitable Remainder Trust Tax Deductible below

How To Do Good And Maximize Tax Savings With A Charitable Remainder Trust

Crypto Charitable Remainder Trust Avoid All Taxes BitcoinTaxes

How A Charitable Remainder Trust Works Strategic Wealth Partners

Is A Charitable Remainder Trust Right For You Napkin Finance

Can I Gain Additional Tax Income Benefits By Using A Charitable

How Does Charitable Remainder Trust Tax Deduction Work Learn With Valur

https://www.schwab.com › learn › stor…

For philanthropically minded investors hoping to minimize taxes a charitable remainder trust CRT allows donors a k a grantors to make a tax deductible gift to charity while also generating income for themselves or their

https://actecfoundation.org › podcasts › …

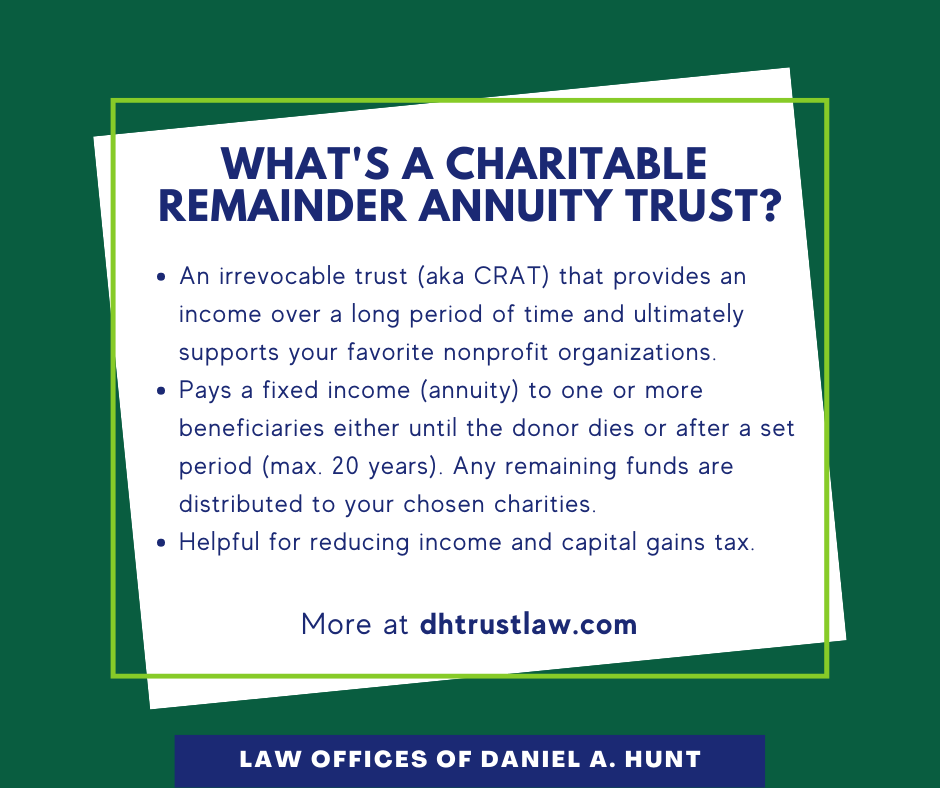

The Charitable Remainder Annuity Trust or CRAT pays a fixed income stream to the taxpayer that is based on a taxpayer chosen percentage of the fair market value of the asset or assets gifted to the CRAT on the date of

For philanthropically minded investors hoping to minimize taxes a charitable remainder trust CRT allows donors a k a grantors to make a tax deductible gift to charity while also generating income for themselves or their

The Charitable Remainder Annuity Trust or CRAT pays a fixed income stream to the taxpayer that is based on a taxpayer chosen percentage of the fair market value of the asset or assets gifted to the CRAT on the date of

Is A Charitable Remainder Trust Right For You Napkin Finance

Crypto Charitable Remainder Trust Avoid All Taxes BitcoinTaxes

Can I Gain Additional Tax Income Benefits By Using A Charitable

How Does Charitable Remainder Trust Tax Deduction Work Learn With Valur

Charitable Remainder Trusts CRT Alterra Advisors

Using A Charitable Remainder Trust CRT To Eliminate Capital Gains

Using A Charitable Remainder Trust CRT To Eliminate Capital Gains

What Is A Charitable Remainder Annuity Trust CRAT