Today, where screens have become the dominant feature of our lives The appeal of tangible printed objects isn't diminished. In the case of educational materials in creative or artistic projects, or simply adding personal touches to your area, Are Contributions To A Charitable Lead Trust Tax Deductible are now a vital resource. Through this post, we'll take a dive into the sphere of "Are Contributions To A Charitable Lead Trust Tax Deductible," exploring what they are, where to find them and ways they can help you improve many aspects of your life.

Get Latest Are Contributions To A Charitable Lead Trust Tax Deductible Below

Are Contributions To A Charitable Lead Trust Tax Deductible

Are Contributions To A Charitable Lead Trust Tax Deductible -

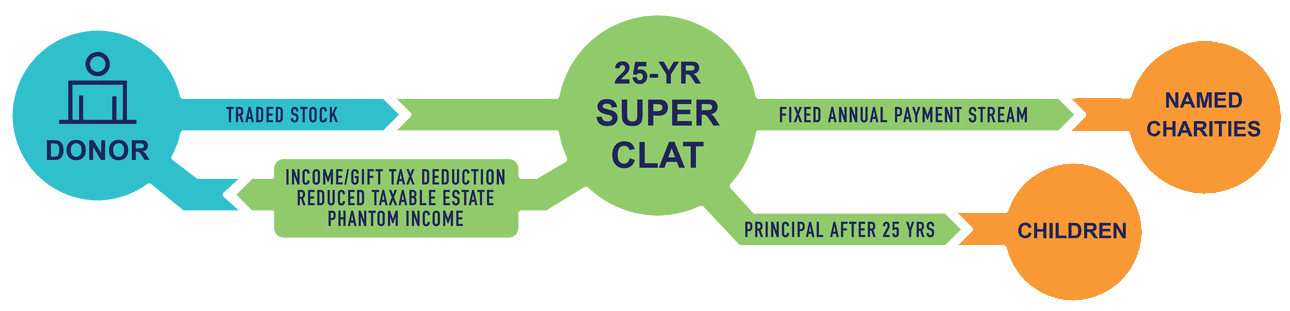

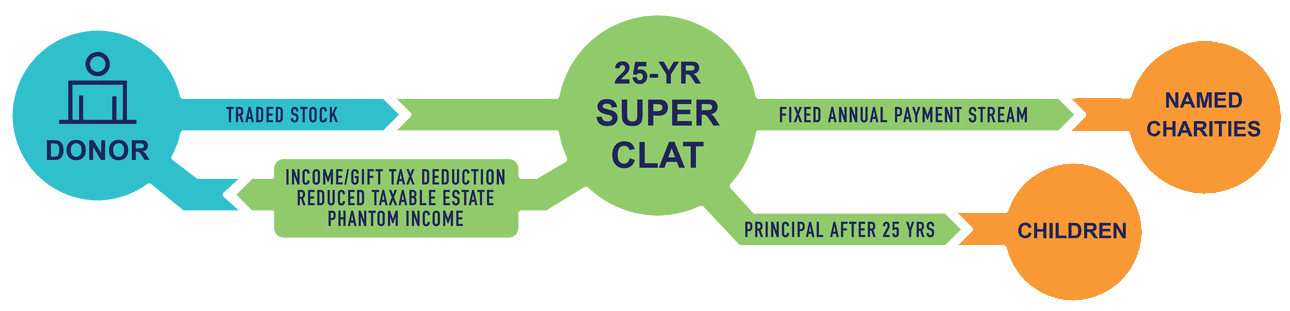

Unlike charitable remainder trusts charitable lead trusts are not tax exempt and therefore annual trust income is either taxed to the grantor for grantor lead trusts or to the trust for non grantor lead trusts

A grantor charitable lead trust will offer a current tax deduction though that may be offset by the fact that income on the trust will be taxable to the donor during the trust term As always if you re considering making

Printables for free include a vast collection of printable materials that are accessible online for free cost. The resources are offered in a variety forms, including worksheets, templates, coloring pages and many more. The great thing about Are Contributions To A Charitable Lead Trust Tax Deductible lies in their versatility as well as accessibility.

More of Are Contributions To A Charitable Lead Trust Tax Deductible

Charitable Lead Trusts Types Taxation

Charitable Lead Trusts Types Taxation

If a Grantor Trust the grantor or donor will get an immediate charitable income tax deduction based on the present value of the charitable annuity then once the trust is operated the grantor will be taxed on all the trust income during the term of the trust

Charitable lead trusts when set up correctly can help reduce income tax estate tax or gift tax for estates or their beneficiaries while providing a way to donate some of the estate to an

The Are Contributions To A Charitable Lead Trust Tax Deductible have gained huge popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Individualization This allows you to modify print-ready templates to your specific requirements when it comes to designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Impact: Free educational printables provide for students of all ages, making them an essential source for educators and parents.

-

Easy to use: immediate access various designs and templates is time-saving and saves effort.

Where to Find more Are Contributions To A Charitable Lead Trust Tax Deductible

What Are Charitable Lead Trusts And How Do They Work

What Are Charitable Lead Trusts And How Do They Work

It discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct It also discusses how much you can deduct what records you must

How ever a charitable trust is not treated as a chari table organization for purposes of exemption from tax Accordingly the trust is subject to the excise tax on its

Since we've got your interest in printables for free Let's see where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection and Are Contributions To A Charitable Lead Trust Tax Deductible for a variety applications.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- The perfect resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a broad array of topics, ranging from DIY projects to party planning.

Maximizing Are Contributions To A Charitable Lead Trust Tax Deductible

Here are some ideas how you could make the most of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print free worksheets to enhance learning at home as well as in the class.

3. Event Planning

- Designs invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Are Contributions To A Charitable Lead Trust Tax Deductible are an abundance of useful and creative resources for a variety of needs and hobbies. Their accessibility and flexibility make them a great addition to each day life. Explore the plethora of Are Contributions To A Charitable Lead Trust Tax Deductible today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Contributions To A Charitable Lead Trust Tax Deductible really for free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I make use of free printables in commercial projects?

- It's contingent upon the specific conditions of use. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables may be subject to restrictions regarding usage. Be sure to check these terms and conditions as set out by the author.

-

How can I print printables for free?

- Print them at home using either a printer or go to a print shop in your area for better quality prints.

-

What program do I need to open Are Contributions To A Charitable Lead Trust Tax Deductible?

- The majority are printed as PDF files, which can be opened with free programs like Adobe Reader.

Choosing A Charitable Lead Trust Vs A Charitable Remainder Trust For

What Is A Charitable Lead Annuity Trust IRS Definition Of A

Check more sample of Are Contributions To A Charitable Lead Trust Tax Deductible below

ShireAbility Art Exhibition 2022 The Disability Trust

International Day Of People With Disability The Disability Trust

Deciding If You Should Use A Charitable Lead Trust PNC Insights

Charitable Lead Trusts AnnuityAdvantage

Charitable Lead Trust Vs Charitable Remainder Trust

Charitable Consider A Charitable Lead Trust

https://www.fidelitycharitable.org/guidance/...

A grantor charitable lead trust will offer a current tax deduction though that may be offset by the fact that income on the trust will be taxable to the donor during the trust term As always if you re considering making

https://www.thetaxadviser.com/issues/2021/mar/...

Income tax charitable deductions for trusts and estates are governed by Sec 642 c Note that these rules are substantially different from those for charitable

A grantor charitable lead trust will offer a current tax deduction though that may be offset by the fact that income on the trust will be taxable to the donor during the trust term As always if you re considering making

Income tax charitable deductions for trusts and estates are governed by Sec 642 c Note that these rules are substantially different from those for charitable

Charitable Lead Trusts AnnuityAdvantage

International Day Of People With Disability The Disability Trust

Charitable Lead Trust Vs Charitable Remainder Trust

Charitable Consider A Charitable Lead Trust

Should A Charitable Lead Trust Be A Part Of My Estate Planning

Charitable Lead Trusts Tax Deductions CLT Annuity Rates RenPSG

Charitable Lead Trusts Tax Deductions CLT Annuity Rates RenPSG

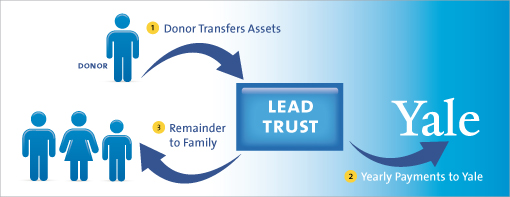

Gift Planning At Yale