In the digital age, where screens rule our lives however, the attraction of tangible printed material hasn't diminished. For educational purposes for creative projects, just adding personal touches to your area, Are Blue Cross Premiums Tax Deductible are now a useful resource. Here, we'll take a dive in the world of "Are Blue Cross Premiums Tax Deductible," exploring the benefits of them, where they can be found, and what they can do to improve different aspects of your daily life.

Get Latest Are Blue Cross Premiums Tax Deductible Below

Are Blue Cross Premiums Tax Deductible

Are Blue Cross Premiums Tax Deductible -

Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and only the amount above that threshold Few taxpayers qualify for the deduction

You can usually deduct the premiums for short term health insurance as a medical expense Short term health insurance premiums are paid out of pocket using pre tax dollars so if you take the

Printables for free include a vast selection of printable and downloadable materials that are accessible online for free cost. These resources come in various kinds, including worksheets templates, coloring pages and much more. The benefit of Are Blue Cross Premiums Tax Deductible is their flexibility and accessibility.

More of Are Blue Cross Premiums Tax Deductible

Are Medicare Premiums Tax Deductible YouTube

Are Medicare Premiums Tax Deductible YouTube

Here s the scoop on what you can and cannot deduct regarding medical insurance premiums come tax time Health Care Premiums May Be Deducted If Your total qualified expenses including eligible health care premiums exceed 10 percent of your adjusted gross income You paid for your health care premiums with your own after tax

Doing taxes for someone who died Medical expenses you can claim To know for whom you can claim medical expenses see How to claim eligible medical expenses on your tax return You can claim only eligible medical expenses on your tax return if you or your spouse or common law partner

Are Blue Cross Premiums Tax Deductible have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: Your HTML0 customization options allow you to customize printed materials to meet your requirements whether you're designing invitations to organize your schedule or decorating your home.

-

Educational Value The free educational worksheets provide for students of all ages. This makes them a great tool for teachers and parents.

-

The convenience of immediate access a myriad of designs as well as templates helps save time and effort.

Where to Find more Are Blue Cross Premiums Tax Deductible

How Much Are Alberta Health Care Premiums Know Alberta

How Much Are Alberta Health Care Premiums Know Alberta

TurboTax Credits and deductions Healthcare and medical expenses What counts as health insurance for my 2023 tax return TurboTax Help Intuit What counts as health insurance for my 2023 tax return SOLVED by TurboTax 6941 Updated 3 weeks ago The following coverage meets the Affordable Care Act minimum requirement for health insurance

Is health insurance tax deductible Health insurance premiums are deductible on federal taxes in some cases as these monthly payments are classified as medical expenses Generally if you pay for medical insurance on your own you can deduct the amount from your taxes

After we've peaked your interest in printables for free we'll explore the places you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Are Blue Cross Premiums Tax Deductible designed for a variety needs.

- Explore categories such as interior decor, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- The blogs are a vast array of topics, ranging that range from DIY projects to party planning.

Maximizing Are Blue Cross Premiums Tax Deductible

Here are some new ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets for free to enhance learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Are Blue Cross Premiums Tax Deductible are an abundance of practical and imaginative resources that satisfy a wide range of requirements and interests. Their accessibility and versatility make them a wonderful addition to both professional and personal lives. Explore the many options of Are Blue Cross Premiums Tax Deductible now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Blue Cross Premiums Tax Deductible truly absolutely free?

- Yes they are! You can download and print the resources for free.

-

Can I utilize free printables in commercial projects?

- It's contingent upon the specific terms of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download Are Blue Cross Premiums Tax Deductible?

- Certain printables may be subject to restrictions on their use. Be sure to read the terms and conditions provided by the author.

-

How do I print Are Blue Cross Premiums Tax Deductible?

- Print them at home using either a printer at home or in an in-store print shop to get higher quality prints.

-

What software will I need to access printables for free?

- Most PDF-based printables are available in the PDF format, and is open with no cost software like Adobe Reader.

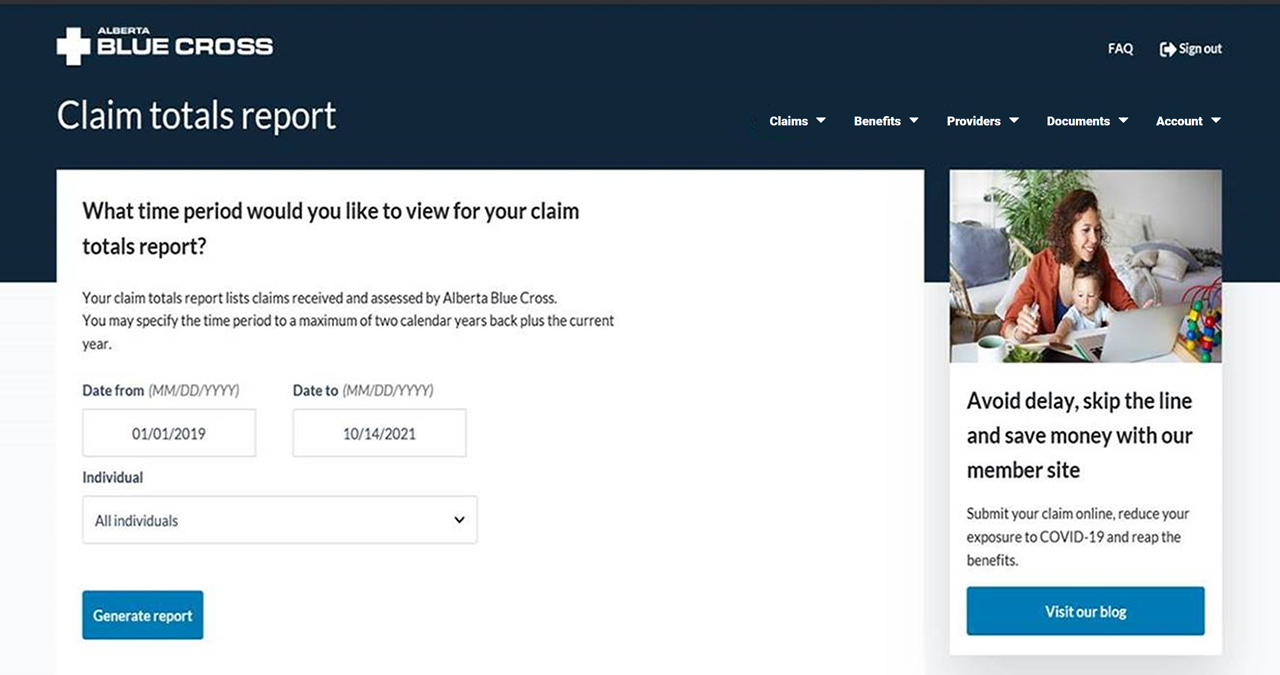

Alberta Blue Cross Retiree Plan CSU 52

.png)

Are Health Insurance Premiums Tax Deductible Investing BB

Check more sample of Are Blue Cross Premiums Tax Deductible below

What Are The 2024 Medicare Part B Premiums And IRMAA Independent

Did You Know Personal Health Insurance Premiums Are An Eligible Tax

Are My Health Insurance Premiums Tax deductible TrueCoverage

Are Group Health Insurance Premiums Tax Deductible Loop

Are Insurance Premiums Tax Deductible AZexplained

Yes Insurance Solutions Insurance Made Easy

https://www.forbes.com/advisor/health-insurance/is...

You can usually deduct the premiums for short term health insurance as a medical expense Short term health insurance premiums are paid out of pocket using pre tax dollars so if you take the

https://ttlc.intuit.com/community/taxes/discussion/...

The exception to this rule is if your premiums are included on your Form W 2 Wage and Tax Statement Then your monthly premiums are tax deductible Can I deduct health insurance premiums taken from my paycheck Medical dental and vision expenses are reported on Schedule A and entered in the Deductions Credits section You can

You can usually deduct the premiums for short term health insurance as a medical expense Short term health insurance premiums are paid out of pocket using pre tax dollars so if you take the

The exception to this rule is if your premiums are included on your Form W 2 Wage and Tax Statement Then your monthly premiums are tax deductible Can I deduct health insurance premiums taken from my paycheck Medical dental and vision expenses are reported on Schedule A and entered in the Deductions Credits section You can

Are Group Health Insurance Premiums Tax Deductible Loop

Did You Know Personal Health Insurance Premiums Are An Eligible Tax

Are Insurance Premiums Tax Deductible AZexplained

Yes Insurance Solutions Insurance Made Easy

Help Get A Tax Receipt

Qualified Business Income Deduction And The Self Employed The CPA Journal

Qualified Business Income Deduction And The Self Employed The CPA Journal

High deductible Health Plan Health Insurance Excellus BlueCross