In this age of electronic devices, when screens dominate our lives, the charm of tangible printed material hasn't diminished. For educational purposes in creative or artistic projects, or simply to add the personal touch to your area, All Tax Credits 2023 can be an excellent source. With this guide, you'll dive deep into the realm of "All Tax Credits 2023," exploring their purpose, where they can be found, and ways they can help you improve many aspects of your lives.

Get Latest All Tax Credits 2023 Below

All Tax Credits 2023

All Tax Credits 2023 - All Tax Credits 2023

A refundable tax credit is a credit you can get as a refund even if you don t owe any tax Tax credits are amounts you subtract from your bottom line tax due when you file your tax return Most tax credits can reduce your tax only until it reaches 0

While you may not be able to avoid paying all taxes there are tax breaks that allow you to lower your 2022 tax bill Tax deductions lower your taxable income how much of your income you actually pay tax on while tax credits are a

All Tax Credits 2023 cover a large selection of printable and downloadable materials online, at no cost. These resources come in many designs, including worksheets templates, coloring pages, and many more. The appeal of printables for free is their flexibility and accessibility.

More of All Tax Credits 2023

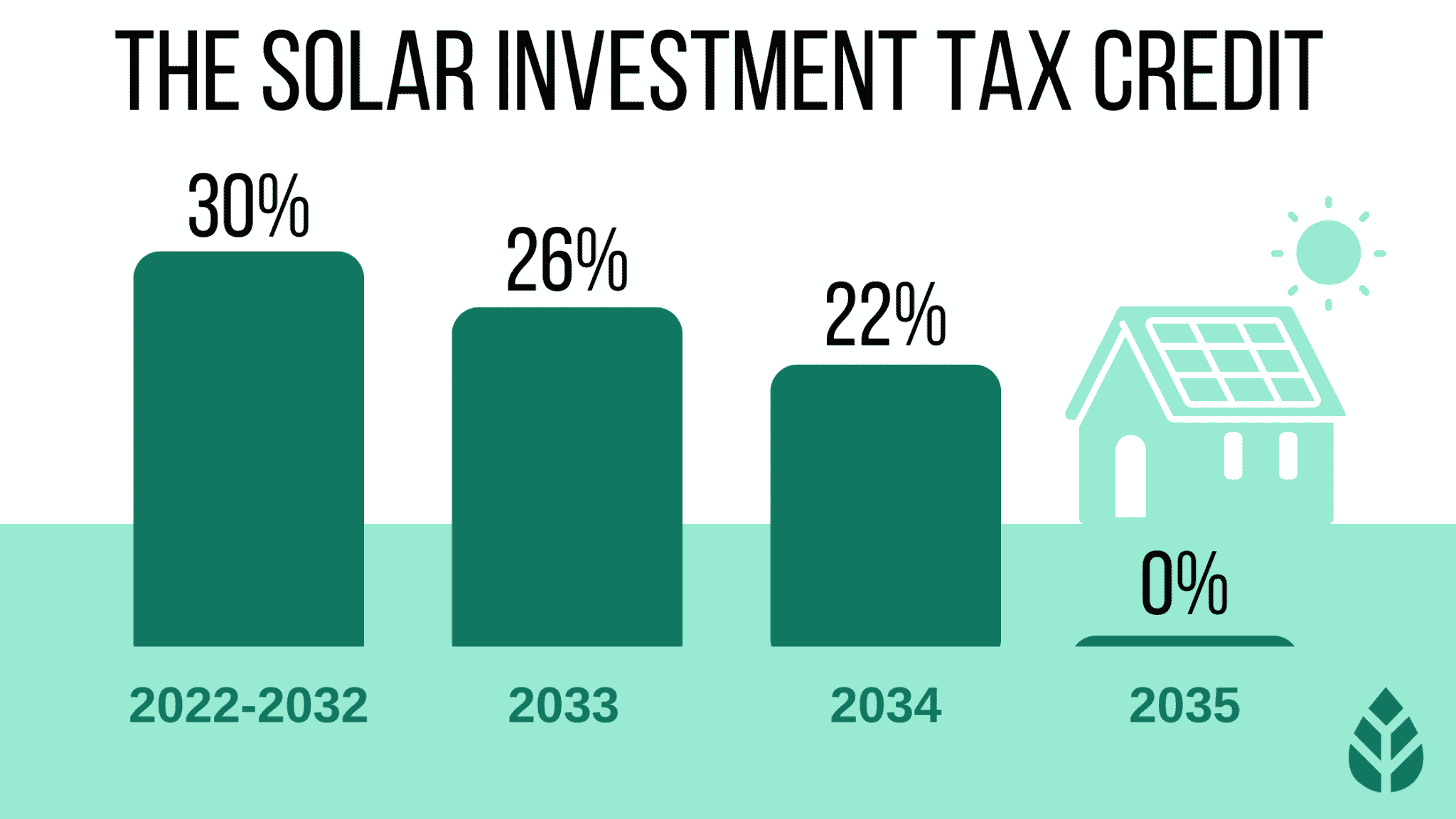

Federal Solar Tax Credit What It Is How To Claim It For 2023

Federal Solar Tax Credit What It Is How To Claim It For 2023

FS 2023 09 April 2023 A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund

9 tax credits to consider when filing your taxes for 2023 Tax credits can give your refund a boost or make a meaningful difference in your tax bill Here are some of the most popular

All Tax Credits 2023 have risen to immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization We can customize printables to fit your particular needs be it designing invitations or arranging your schedule or decorating your home.

-

Educational Worth: Education-related printables at no charge cater to learners of all ages, which makes them a great tool for parents and teachers.

-

Easy to use: You have instant access the vast array of design and templates saves time and effort.

Where to Find more All Tax Credits 2023

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

OVERVIEW Federal tax credits can be a big help to low to moderate income taxpayers looking to reduce their taxes or maximize their tax refund Here are the 5 biggest tax credits you might qualify for TABLE OF CONTENTS Tax credits 1 Earned Income Tax Credit 2 American Opportunity Tax Credit Click to expand Key Takeaways

Start filing When it comes to taxes there s no one size fits all scenario That s why t here are over 400 deductions and credits that the CRA outlines We ve rounded up the top 20 most popular items to help you make the most out of your taxes and get the best refund aftering filing your return

Since we've got your interest in All Tax Credits 2023 we'll explore the places the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of All Tax Credits 2023 suitable for many reasons.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- The blogs covered cover a wide variety of topics, that includes DIY projects to party planning.

Maximizing All Tax Credits 2023

Here are some fresh ways create the maximum value use of All Tax Credits 2023:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print out free worksheets and activities to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

All Tax Credits 2023 are a treasure trove of practical and innovative resources for a variety of needs and pursuits. Their access and versatility makes them a great addition to the professional and personal lives of both. Explore the vast world of All Tax Credits 2023 to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes they are! You can download and print these files for free.

-

Can I make use of free printables for commercial purposes?

- It's determined by the specific usage guidelines. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns when using All Tax Credits 2023?

- Some printables may contain restrictions regarding their use. Be sure to check the conditions and terms of use provided by the designer.

-

How can I print All Tax Credits 2023?

- You can print them at home with either a printer at home or in the local print shop for the highest quality prints.

-

What program must I use to open printables for free?

- Many printables are offered in PDF format. These can be opened with free programs like Adobe Reader.

TaxTips ca 2023 Non Refundable Personal Tax Credits Tax Amounts

Solved E Apply The Tax Rates Shown In The Table Below To Chegg

Check more sample of All Tax Credits 2023 below

GST Filing Services Sherwood Park Corporate Tax And Accounting

The Best Money saving Tax Credits And Deductions

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Tax Credits In The Dutch Payroll Administration Expatax

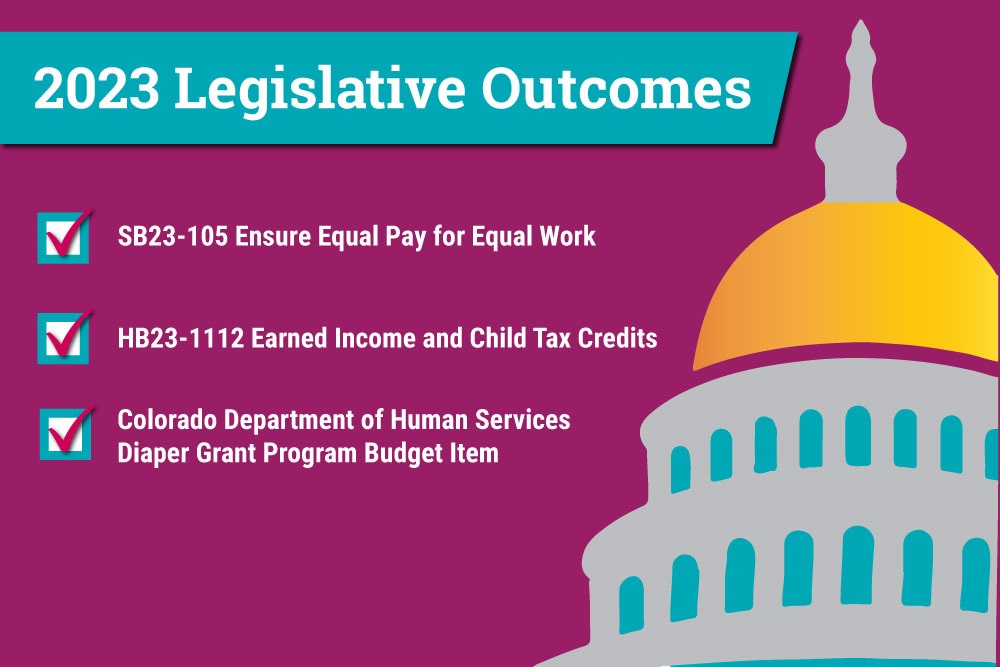

2023 Legislative Session Some Progress To Celebrate But Opportunities

Marketplace Tax Credits And Understanding It All YouTube

https://www.policygenius.com/taxes/tax-deductions...

While you may not be able to avoid paying all taxes there are tax breaks that allow you to lower your 2022 tax bill Tax deductions lower your taxable income how much of your income you actually pay tax on while tax credits are a

https://www.irs.gov/credits

You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified dependents you may be eligible for certain credits and deductions

While you may not be able to avoid paying all taxes there are tax breaks that allow you to lower your 2022 tax bill Tax deductions lower your taxable income how much of your income you actually pay tax on while tax credits are a

You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified dependents you may be eligible for certain credits and deductions

Tax Credits In The Dutch Payroll Administration Expatax

The Best Money saving Tax Credits And Deductions

2023 Legislative Session Some Progress To Celebrate But Opportunities

Marketplace Tax Credits And Understanding It All YouTube

What Tax Credits Can I Expect In 2023

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Credits Save You More Than Deductions Here Are The Best Ones

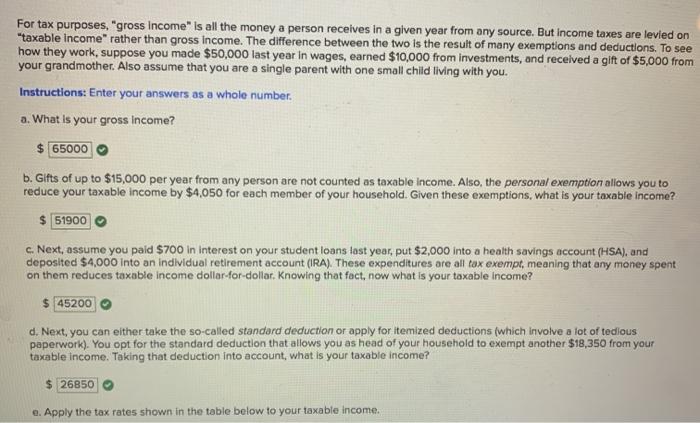

For Tax Purposes gross Income Is All The Money A Person Receives In