In this day and age where screens rule our lives, the charm of tangible printed materials isn't diminishing. Be it for educational use for creative projects, just adding an individual touch to your area, Adoption Tax Credit Limit are now a useful resource. The following article is a take a dive into the world "Adoption Tax Credit Limit," exploring the benefits of them, where they are available, and how they can add value to various aspects of your lives.

Get Latest Adoption Tax Credit Limit Below

Adoption Tax Credit Limit

Adoption Tax Credit Limit -

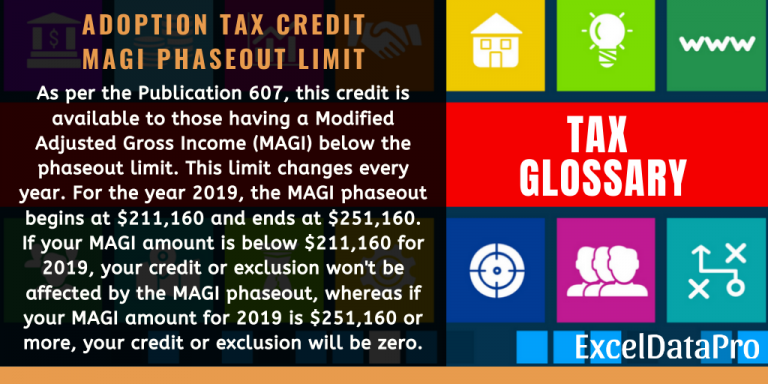

To claim the credit you have to file Form 8839 Qualified Adoption Expenses and meet the modified adjusted gross income MAGI limits Your credit phases out between MAGIs of 239 230 and 279 230 in 2023 For 2024 the credit phases out with MAGI between 252 150 and 292 150

The maximum adoption credit allowable in 2023 is 7 950 15 950 dollar limit for 2023 less 8 000 previously claimed The dollar limitation applies separately to both the credit and the exclusion and you may be able to claim both the credit and the exclusion for qualified expenses

Adoption Tax Credit Limit cover a large variety of printable, downloadable resources available online for download at no cost. They are available in numerous designs, including worksheets templates, coloring pages, and much more. The appeal of printables for free is their flexibility and accessibility.

More of Adoption Tax Credit Limit

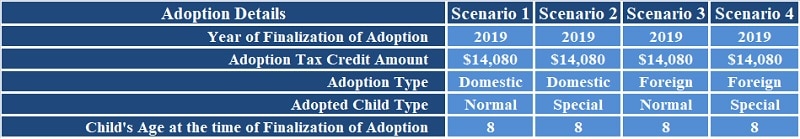

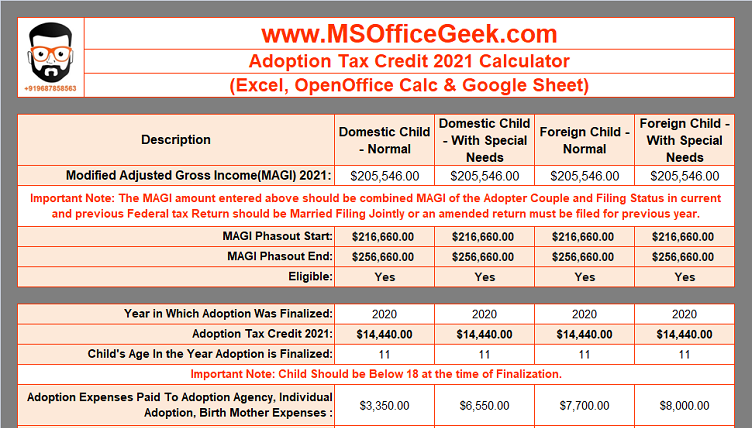

Ready T Use Adoption Tax Credit 2022 Calculator MSOfficeGeek

Ready T Use Adoption Tax Credit 2022 Calculator MSOfficeGeek

Adoption Tax Credit FAQs How much is the adoption tax credit For adoptions finalized in 2023 tax returns claimed in early 2024 the maximum amount a family can receive as credit is 15 950 this information is updated here annually Does the adoption tax credit just reduce my federal tax liability or does it also reduce my state

CREDIT AMOUNT Taxpayers can receive a tax credit for all qualifying adoption expenses up to 14 300 in 2020 The maximum credit is indexed for inflation Taxpayers may also exclude from income qualified adoption expenses paid or reimbursed by an employer up to the same limit as the credit

Adoption Tax Credit Limit have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Modifications: Your HTML0 customization options allow you to customize printables to your specific needs whether you're designing invitations to organize your schedule or decorating your home.

-

Educational value: These Adoption Tax Credit Limit provide for students of all ages, which makes them an essential tool for parents and teachers.

-

Simple: instant access a plethora of designs and templates will save you time and effort.

Where to Find more Adoption Tax Credit Limit

Adoption Tax Credit Explained YouTube

Adoption Tax Credit Explained YouTube

For the 2021 Adoption Tax Credit the maximum amount available will be available for those with a MAGI below 216 660 The credit will begin to phase out for families with a MAGI above that amount and will be unavailable to

You can t get the credit if you earn more than 241 010 Adoption benefits exclusion If your employer offers an adoption assistance program you can exclude up to 15 950 from your income in 2023 The income limits apply to this tax benefit too Your employer will report these benefits on your W 2 Box 12 and mark it with the code T

In the event that we've stirred your interest in Adoption Tax Credit Limit we'll explore the places you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Adoption Tax Credit Limit to suit a variety of reasons.

- Explore categories such as interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free as well as flashcards and other learning materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs are a vast array of topics, ranging everything from DIY projects to planning a party.

Maximizing Adoption Tax Credit Limit

Here are some unique ways ensure you get the very most use of Adoption Tax Credit Limit:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home and in class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Adoption Tax Credit Limit are an abundance of fun and practical tools which cater to a wide range of needs and preferences. Their access and versatility makes them a fantastic addition to any professional or personal life. Explore the plethora of Adoption Tax Credit Limit right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Adoption Tax Credit Limit really available for download?

- Yes you can! You can download and print these tools for free.

-

Can I download free templates for commercial use?

- It's based on the rules of usage. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues with Adoption Tax Credit Limit?

- Some printables may come with restrictions on use. Be sure to check the terms and conditions offered by the creator.

-

How do I print printables for free?

- You can print them at home with either a printer or go to the local print shops for higher quality prints.

-

What software do I need in order to open printables at no cost?

- Many printables are offered as PDF files, which can be opened with free software, such as Adobe Reader.

Resource Spotlight Adoption Tax Credit For 2017 America World Adoption

Adoption Tax Credit Survives Overhaul

Check more sample of Adoption Tax Credit Limit below

Shiba Inu Crypto Coin

Little Miracles Adoption News The Adoption Tax Credit Impacts Families

Giving Adoption Tax Credit Where Credit Is Due Foster Care Newsletter

2021 Adoption Tax Credit Adoption Choices Of Arizona

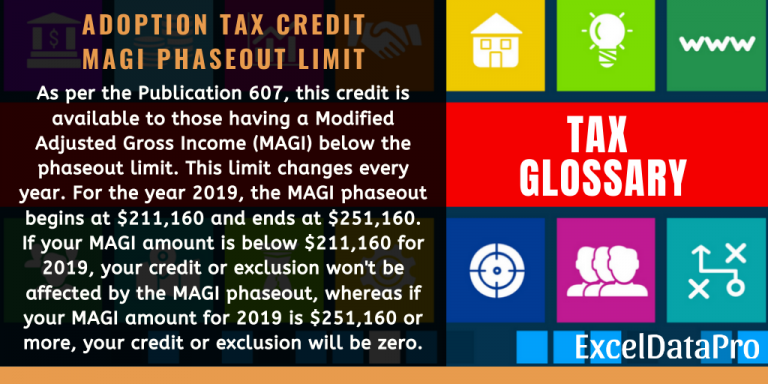

What Is Adoption Tax Credit Definition Limit Eligibility ExcelDataPro

30 Credit Limit Worksheet

https://www.irs.gov/taxtopics/tc607

The maximum adoption credit allowable in 2023 is 7 950 15 950 dollar limit for 2023 less 8 000 previously claimed The dollar limitation applies separately to both the credit and the exclusion and you may be able to claim both the credit and the exclusion for qualified expenses

https://www.irs.gov/instructions/i8839

Part II Adoption Credit Line 2 The maximum adoption credit is 15 950 per child Enter 15 950 on line 2 If you and another person other than your spouse if filing jointly each paid qualified adoption expenses to adopt the same child the 15 950 limit must be divided between the two of you You can divide it in any way you both agree

The maximum adoption credit allowable in 2023 is 7 950 15 950 dollar limit for 2023 less 8 000 previously claimed The dollar limitation applies separately to both the credit and the exclusion and you may be able to claim both the credit and the exclusion for qualified expenses

Part II Adoption Credit Line 2 The maximum adoption credit is 15 950 per child Enter 15 950 on line 2 If you and another person other than your spouse if filing jointly each paid qualified adoption expenses to adopt the same child the 15 950 limit must be divided between the two of you You can divide it in any way you both agree

2021 Adoption Tax Credit Adoption Choices Of Arizona

Little Miracles Adoption News The Adoption Tax Credit Impacts Families

What Is Adoption Tax Credit Definition Limit Eligibility ExcelDataPro

30 Credit Limit Worksheet

Form 8812 Worksheet Printable Word Searches

2022 How Does The Adoption Tax Credit Work Struggle Shuttle

2022 How Does The Adoption Tax Credit Work Struggle Shuttle

About The Adoption Tax Credit For The 2020 Tax Year About The Adoption