In the digital age, with screens dominating our lives, the charm of tangible printed materials hasn't faded away. In the case of educational materials and creative work, or just adding the personal touch to your space, 80g Tax Exemption can be an excellent source. This article will take a dive into the world of "80g Tax Exemption," exploring what they are, how to find them and the ways that they can benefit different aspects of your life.

Get Latest 80g Tax Exemption Below

80g Tax Exemption

80g Tax Exemption -

Contributions to relief funds and humanitarian organizations can be deducted under Section 80G of the Internal Revenue Code Any taxpayer whether a person a corporation a partnership or another entity may claim this deduction Section 80G

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals as well as companies The deduction under section 80G can be claimed on the amount donated to eligible institutions or funds

80g Tax Exemption encompass a wide array of printable resources available online for download at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages and more. The great thing about 80g Tax Exemption is in their variety and accessibility.

More of 80g Tax Exemption

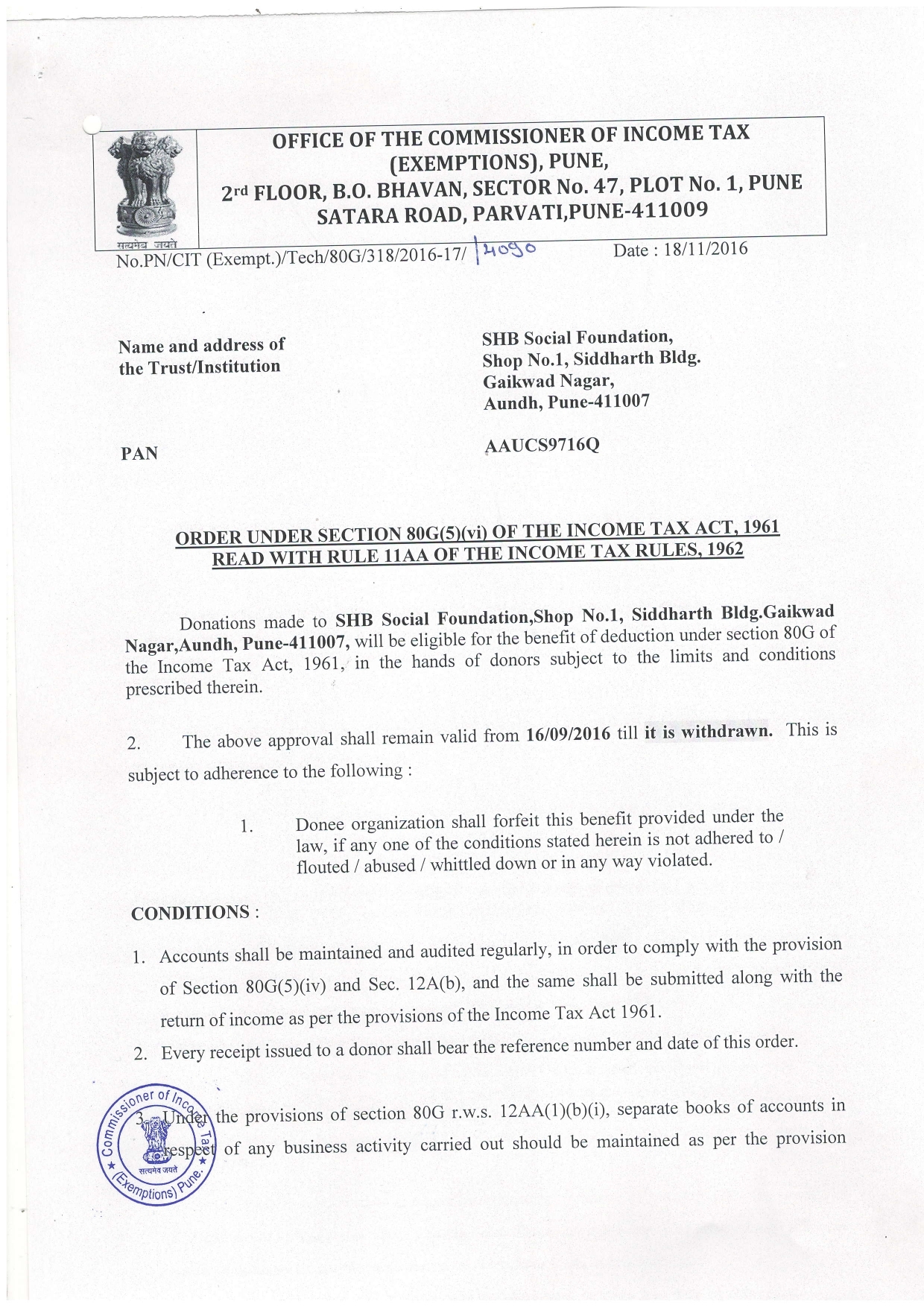

Tax Exemption 80G Certificate

Tax Exemption 80G Certificate

Which donation is eligible for a 50 deduction under section 80G Donations made towards trusts like the Prime Minister s Drought Relief Fund National Children s Fund Indira Gandhi Memorial Fund etc are eligible

Introduced and implemented in 1961 Section 80G of the Income Tax Act enables taxpayers to claim up to 50 to 100 of their charitable donations as tax deductions This act encourages donors to invest more in change and take steps towards a positive social impact with their small acts of generosity

80g Tax Exemption have garnered immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Flexible: You can tailor printing templates to your own specific requirements be it designing invitations to organize your schedule or even decorating your house.

-

Education Value Printing educational materials for no cost cater to learners of all ages, which makes these printables a powerful device for teachers and parents.

-

An easy way to access HTML0: The instant accessibility to numerous designs and templates is time-saving and saves effort.

Where to Find more 80g Tax Exemption

Online Step To Download 80G Receipt For Donation Made To PM Cares Fund

Online Step To Download 80G Receipt For Donation Made To PM Cares Fund

Section 80G of Indian Income Tax Act allows tax deductions for donations made to charitable trusts or NGOs Charitable institutions play a crucial role in social welfare and economic development receiving exemptions under certain conditions

Section 80G of income tax act allows a deduction for any contribution made to certain relief funds and charitable institutions This deduction can be claimed by all types of taxpayers including NRIs i e individuals HUFs companies firms or any other person

If we've already piqued your curiosity about 80g Tax Exemption Let's see where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of 80g Tax Exemption suitable for many uses.

- Explore categories like the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets including flashcards, learning materials.

- The perfect resource for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- The blogs covered cover a wide spectrum of interests, all the way from DIY projects to planning a party.

Maximizing 80g Tax Exemption

Here are some innovative ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print out free worksheets and activities for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

80g Tax Exemption are a treasure trove of fun and practical tools which cater to a wide range of needs and interests. Their accessibility and flexibility make these printables a useful addition to any professional or personal life. Explore the vast collection of 80g Tax Exemption right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes, they are! You can print and download these items for free.

-

Can I download free templates for commercial use?

- It's contingent upon the specific usage guidelines. Always check the creator's guidelines before using their printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may contain restrictions in their usage. You should read the terms of service and conditions provided by the creator.

-

How do I print 80g Tax Exemption?

- Print them at home with your printer or visit an area print shop for premium prints.

-

What program will I need to access printables that are free?

- The majority of printables are with PDF formats, which can be opened using free software like Adobe Reader.

Exemption U s 80G Can t Be Granted If Expenditure Of Religious Nature

Are SIP Donations Eligible For 80G Tax Exemption Deductions Ketto

Check more sample of 80g Tax Exemption below

SHB 80G Certificate SHB Social Foundation

Chapter VI A 80G Deduction For Donation To Charitable Institution

Section 80g Deduction 80g Section 80g Of Income Tax Act 2020 21

Tax Exemption For NGOs Section 12A 80G Corpbiz

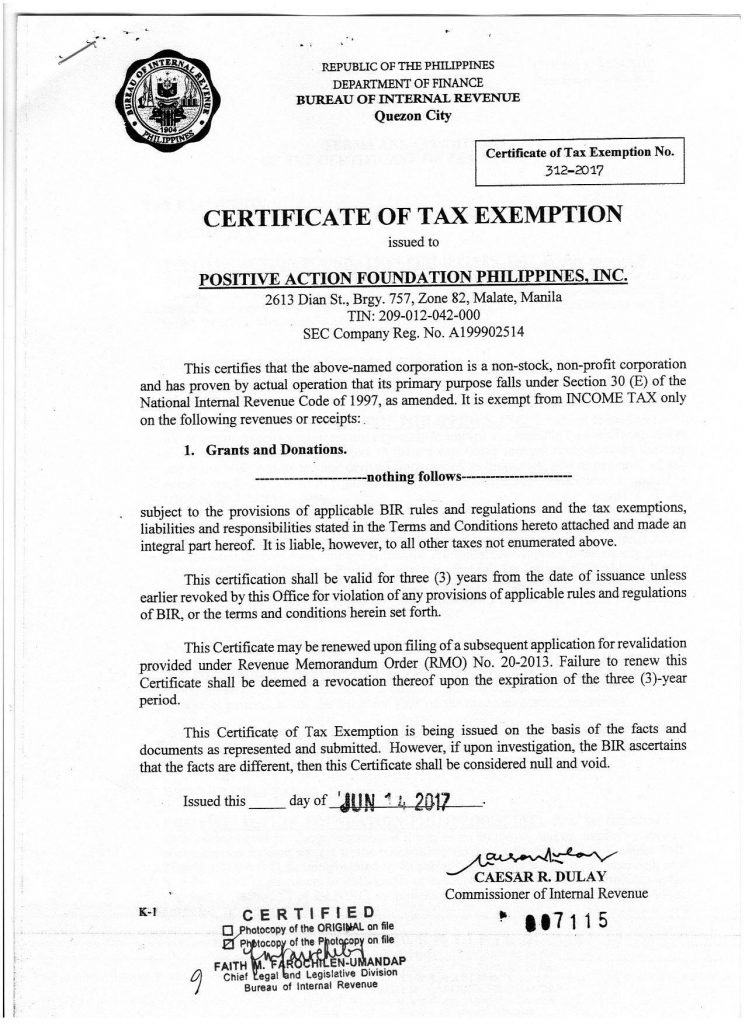

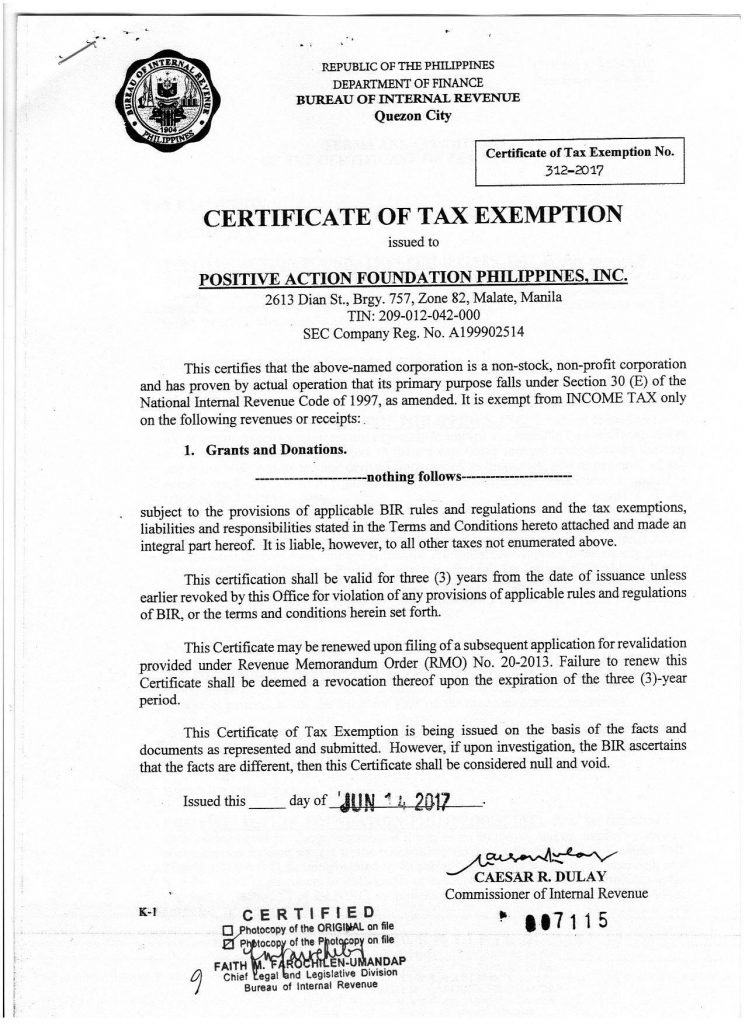

Certificate Of TAX Exemption PAFPI

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

https://tax2win.in/guide/80g-deduction-donations...

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals as well as companies The deduction under section 80G can be claimed on the amount donated to eligible institutions or funds

https://economictimes.indiatimes.com/wealth/tax/...

Section 80G of the Income Tax Act 1961 allows taxpayers to save tax by donating money to eligible charitable institutions By donating to eligible institutions and organisations taxpayers can claim deductions ranging from

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals as well as companies The deduction under section 80G can be claimed on the amount donated to eligible institutions or funds

Section 80G of the Income Tax Act 1961 allows taxpayers to save tax by donating money to eligible charitable institutions By donating to eligible institutions and organisations taxpayers can claim deductions ranging from

Tax Exemption For NGOs Section 12A 80G Corpbiz

Chapter VI A 80G Deduction For Donation To Charitable Institution

Certificate Of TAX Exemption PAFPI

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

The Myths And Realities Of 80g Tax Exemption Devpost

The 80G Certificate And Tax Exemption For Nonprofits Vakilsearch Blog

The 80G Certificate And Tax Exemption For Nonprofits Vakilsearch Blog

How To Register U s 80G Of Income Tax Act Good Karma For NGOs