In the digital age, where screens rule our lives however, the attraction of tangible printed objects isn't diminished. Whether it's for educational purposes such as creative projects or simply adding an element of personalization to your area, 80c Tax Exemption Fixed Deposit are a great source. With this guide, you'll take a dive to the depths of "80c Tax Exemption Fixed Deposit," exploring what they are, how they are, and what they can do to improve different aspects of your lives.

Get Latest 80c Tax Exemption Fixed Deposit Below

80c Tax Exemption Fixed Deposit

80c Tax Exemption Fixed Deposit -

Tax saving FDs are like regular fixed deposits but come with a lock in period of 5 years and tax break under Section 80C on investments of up to Rs 1 5 lakh Eligibility Can be opened by Resident Indian individuals Liquidity Fixed Deposits have lock in period of

Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can reinvest the sum for another term Loan against FDs are available Investors will accumulate higher returns if they invest for an extended period

80c Tax Exemption Fixed Deposit cover a large assortment of printable, downloadable content that can be downloaded from the internet at no cost. They are available in a variety of formats, such as worksheets, templates, coloring pages and many more. The great thing about 80c Tax Exemption Fixed Deposit lies in their versatility as well as accessibility.

More of 80c Tax Exemption Fixed Deposit

SBI Tax Savings Fixed Deposit Account State Bank Of India Revised

SBI Tax Savings Fixed Deposit Account State Bank Of India Revised

Updated 26 10 2023 10 39 04 AM Fixed deposits are one of the most preferred choices for investors looking for low risk investment options Along with scaling significantly low on risk factor fixed deposits also let investors avail deductions under section 80C of the Income Tax Act 1961

Fixed Deposits were included under exemption under Section 80 C of Income Tax 1963 in 2006 To avail FD as a tax saving option the individual is required to deposit a lump sum amount for a particular duration These deposits can be of two types Single holder Deposits and Joint holder Deposits

80c Tax Exemption Fixed Deposit have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

customization Your HTML0 customization options allow you to customize printing templates to your own specific requirements when it comes to designing invitations and schedules, or even decorating your home.

-

Education Value Printing educational materials for no cost can be used by students of all ages. This makes them a useful source for educators and parents.

-

Convenience: You have instant access a plethora of designs and templates will save you time and effort.

Where to Find more 80c Tax Exemption Fixed Deposit

EP5 80C TAX Tax

EP5 80C TAX Tax

A tax saving FD offers tax exemption under Section 80C of the Income Tax Act 1961 You could get tax exemption up to Rs 1 50 000 You should also know that a tax saving fixed deposit scheme comes with a lock in period of 5 10 years A lock in period means you will not be able to withdraw your money until the maturity of the deposit

Tax Saving FD is a type of deposit scheme in which you can get tax deduction under section 80C of the Indian Income Tax Act 1961 Any investor who makes an investment in tax saver FDs can claim a deduction on the investment amount up to Rs 1 5 lakh

Now that we've piqued your interest in 80c Tax Exemption Fixed Deposit Let's take a look at where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of 80c Tax Exemption Fixed Deposit designed for a variety reasons.

- Explore categories such as home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- The blogs covered cover a wide array of topics, ranging all the way from DIY projects to planning a party.

Maximizing 80c Tax Exemption Fixed Deposit

Here are some ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets for free to aid in learning at your home also in the classes.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

80c Tax Exemption Fixed Deposit are an abundance of creative and practical resources that meet a variety of needs and needs and. Their availability and versatility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the vast world of 80c Tax Exemption Fixed Deposit today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are 80c Tax Exemption Fixed Deposit truly completely free?

- Yes they are! You can download and print these free resources for no cost.

-

Do I have the right to use free printables for commercial purposes?

- It's determined by the specific conditions of use. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright issues with 80c Tax Exemption Fixed Deposit?

- Some printables could have limitations in their usage. Be sure to read the terms and regulations provided by the author.

-

How do I print 80c Tax Exemption Fixed Deposit?

- You can print them at home with the printer, or go to the local print shop for more high-quality prints.

-

What software do I need in order to open printables that are free?

- Most PDF-based printables are available in PDF format. These can be opened using free software such as Adobe Reader.

FIXED DEPOSIT FD Upto 7 Interest Per Year In India Post II Best

Section 80C Deductions List To Save Income Tax FinCalC Blog

Check more sample of 80c Tax Exemption Fixed Deposit below

Benefits Of Tax Savings On Fixed Deposit Under Section 80c Deduction

How NRIs Can Invest In NRO Tax Saver Fixed Deposit For Tax Saving Under

Tax Saving Fixed Deposits 10

Stamp Duty And Registration Charges Deduction U s 80C

Exemption In Lieu Of 80C Tax Benefits

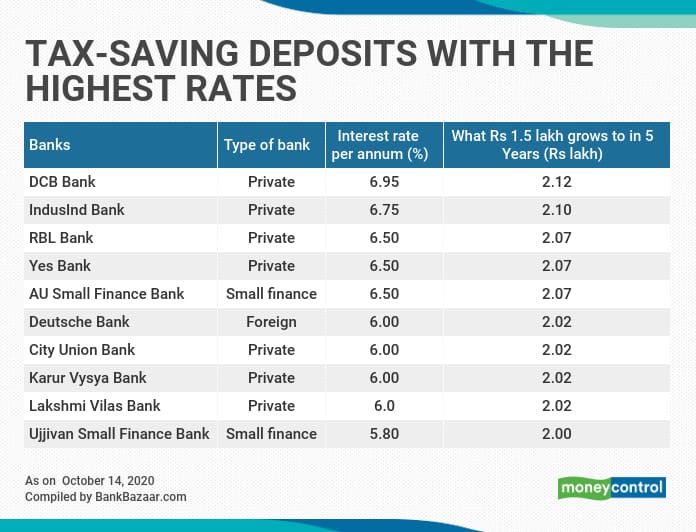

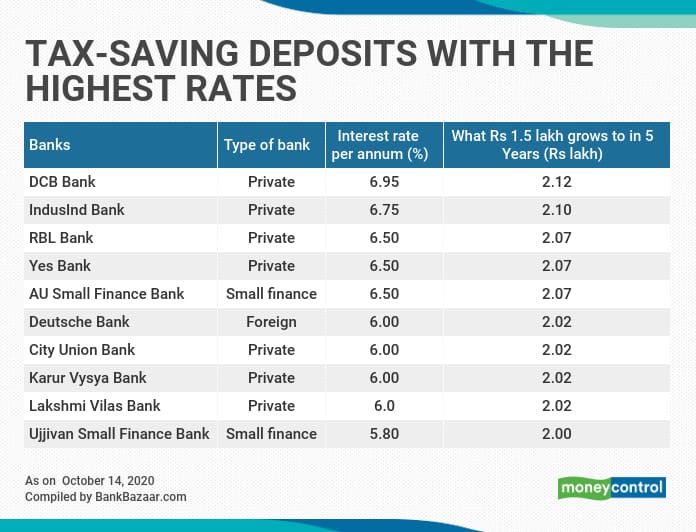

Highest Tax Saving Bank Fixed Deposit Rates 80c May 2018 Bank2home

https:// cleartax.in /s/fixed-deposit

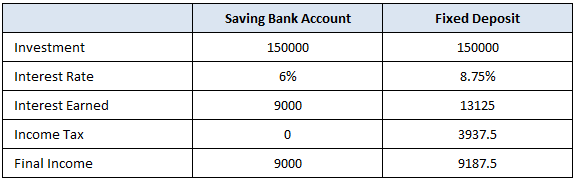

Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can reinvest the sum for another term Loan against FDs are available Investors will accumulate higher returns if they invest for an extended period

https://www. paisabazaar.com /fixed-deposit/tax...

However one can claim a tax deduction by investing in a tax saving fixed deposit scheme offered by different banks The principal component of Tax Saver FDs of up to Rs 1 5 lakhs each financial year would qualify for tax deduction under Section 80C

Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can reinvest the sum for another term Loan against FDs are available Investors will accumulate higher returns if they invest for an extended period

However one can claim a tax deduction by investing in a tax saving fixed deposit scheme offered by different banks The principal component of Tax Saver FDs of up to Rs 1 5 lakhs each financial year would qualify for tax deduction under Section 80C

Stamp Duty And Registration Charges Deduction U s 80C

How NRIs Can Invest In NRO Tax Saver Fixed Deposit For Tax Saving Under

Exemption In Lieu Of 80C Tax Benefits

Highest Tax Saving Bank Fixed Deposit Rates 80c May 2018 Bank2home

Rs 10 000 Income Tax Exemption On Saving Bank Interest Sec 80TTA

Section 80C Deduction Under Section 80C In India Paisabazaar

Section 80C Deduction Under Section 80C In India Paisabazaar

Bharat Bank