In the digital age, where screens rule our lives and the appeal of physical printed objects hasn't waned. In the case of educational materials and creative work, or simply adding a personal touch to your area, 80c Tax Deduction List are now an essential resource. The following article is a dive through the vast world of "80c Tax Deduction List," exploring the benefits of them, where to get them, as well as what they can do to improve different aspects of your lives.

Get Latest 80c Tax Deduction List Below

80c Tax Deduction List

80c Tax Deduction List -

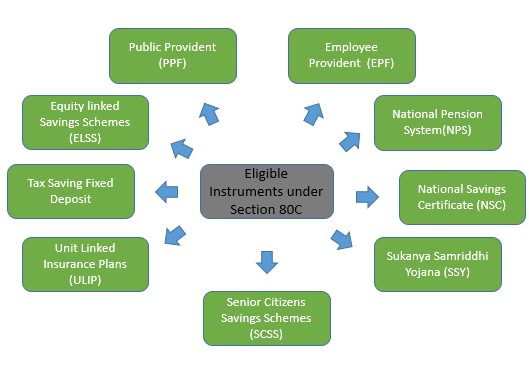

Individuals both Indian residents and Non Resident Indians NRIs are eligible to claim a deduction under Section 80C of The Income Tax Act 1961 This category covers

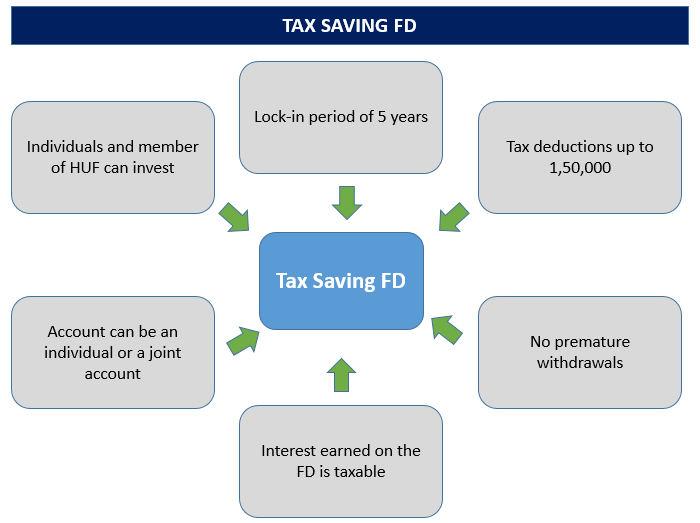

In Budget 2021 update unpaid PF contributions by employer can t be deducted Section 80C offers tax saving investment options including ELSS funds which provide higher returns than FDs with a 3

80c Tax Deduction List provide a diverse variety of printable, downloadable materials available online at no cost. They are available in a variety of forms, like worksheets templates, coloring pages and much more. The great thing about 80c Tax Deduction List is in their variety and accessibility.

More of 80c Tax Deduction List

Section 80C Deductions List Save Income Tax With Section 80C Options

Section 80C Deductions List Save Income Tax With Section 80C Options

Section 80C of the Income Tax Act is the most popular income tax deduction for tax saving 80C deduction limit for the current FY 2023 24 AY 2024 25 is Rs 1 50 000 However ITR filing is mandatory

Section 80C Deduction List There are over a dozen avenues that taxpayers could use See Section 80C umbrella for Assessment Year 2020 21 FY 2019 20 to save tax

The 80c Tax Deduction List have gained huge popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Individualization They can make print-ready templates to your specific requirements, whether it's designing invitations to organize your schedule or even decorating your house.

-

Educational Use: Education-related printables at no charge can be used by students of all ages, making the perfect tool for parents and teachers.

-

The convenience of instant access numerous designs and templates will save you time and effort.

Where to Find more 80c Tax Deduction List

Deduction Under Section 80C Its Allied Sections

Deduction Under Section 80C Its Allied Sections

The Income Tax Act 1961 referred to as the IT Act under chapter VI A provides some of the most popular and commonly availed deductions such as deductions under Section

Section 80C of the Income Tax Act offers individuals and Hindu Undivided Families HUFs the opportunity to reduce their taxable income by making eligible investments and

Since we've got your curiosity about 80c Tax Deduction List, let's explore where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of 80c Tax Deduction List to suit a variety of needs.

- Explore categories like decoration for your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Great for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- These blogs cover a wide range of topics, from DIY projects to planning a party.

Maximizing 80c Tax Deduction List

Here are some inventive ways to make the most use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

80c Tax Deduction List are an abundance of practical and innovative resources that cater to various needs and interests. Their access and versatility makes them a wonderful addition to the professional and personal lives of both. Explore the vast array of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes, they are! You can download and print these materials for free.

-

Can I use the free printables for commercial purposes?

- It's based on specific usage guidelines. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues with 80c Tax Deduction List?

- Certain printables may be subject to restrictions in use. Check these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home using the printer, or go to a local print shop to purchase the highest quality prints.

-

What software will I need to access 80c Tax Deduction List?

- Many printables are offered in the PDF format, and can be opened using free software such as Adobe Reader.

80C TO 80U DEDUCTIONS LIST PDF

Top 5 Post Office Tax Saving Schemes Offering Income Tax Deduction

Check more sample of 80c Tax Deduction List below

List Of Deductions Under Section 80C Finserv MARKETS

INCOME TAX DEDUCTION 80C YouTube

How To Claim Health Insurance Under Section 80D From 2018 19

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

80C Best Tax Deduction Section

Deduction Under Section 80C A Complete List BasuNivesh

https://cleartax.in/s/80C-Deductions

In Budget 2021 update unpaid PF contributions by employer can t be deducted Section 80C offers tax saving investment options including ELSS funds which provide higher returns than FDs with a 3

https://groww.in/p/tax/section-80c

Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax It allows for a maximum deduction

In Budget 2021 update unpaid PF contributions by employer can t be deducted Section 80C offers tax saving investment options including ELSS funds which provide higher returns than FDs with a 3

Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax It allows for a maximum deduction

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

INCOME TAX DEDUCTION 80C YouTube

80C Best Tax Deduction Section

Deduction Under Section 80C A Complete List BasuNivesh

How To Claim Deduction In 80C incometax taxdeductions 80c

Tax Deductions 80C To 80U YouTube

Tax Deductions 80C To 80U YouTube

Section 80C Deduction For Tax Saving Investments Learn By Quicko