In a world where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. For educational purposes such as creative projects or just adding an individual touch to the area, 48c Tax Credit Inflation Reduction Act have become a valuable source. For this piece, we'll dive into the sphere of "48c Tax Credit Inflation Reduction Act," exploring the benefits of them, where to get them, as well as how they can add value to various aspects of your life.

Get Latest 48c Tax Credit Inflation Reduction Act Below

48c Tax Credit Inflation Reduction Act

48c Tax Credit Inflation Reduction Act -

IR 2023 27 Feb 13 2023 The Department of the Treasury and the Internal Revenue Service today provided guidance following the enactment of the Inflation Reduction Act

The Inflation Reduction Act IRA provided 10 billion in funding for the Qualifying Advanced Energy Project Credit Allocation Program under section 48C e These

Printables for free cover a broad array of printable items that are available online at no cost. They are available in a variety of forms, like worksheets templates, coloring pages, and many more. The attraction of printables that are free is their flexibility and accessibility.

More of 48c Tax Credit Inflation Reduction Act

How The Inflation Reduction Act Is Extending Solar Energy Tax Incentives

How The Inflation Reduction Act Is Extending Solar Energy Tax Incentives

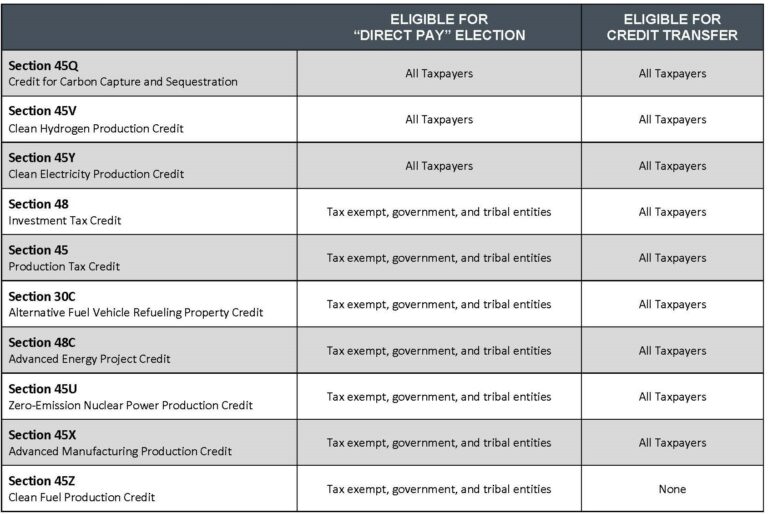

Reinstated by the Inflation Reduction Act of 2022 IRA Section 48C of the Internal Revenue Code provides 10 billion in credits for qualifying advanced energy

Treasury and IRS established the expanded Qualifying Advanced Energy Project Credit program under section 48C of the Internal Revenue Code on February 13

The 48c Tax Credit Inflation Reduction Act have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Flexible: They can make printables to fit your particular needs for invitations, whether that's creating them planning your schedule or even decorating your house.

-

Educational Value Downloads of educational content for free offer a wide range of educational content for learners of all ages, making them an invaluable tool for parents and teachers.

-

Convenience: instant access numerous designs and templates reduces time and effort.

Where to Find more 48c Tax Credit Inflation Reduction Act

What You Need To Know About The Inflation Reduction Act Traders

What You Need To Know About The Inflation Reduction Act Traders

The Inflation Reduction Act IRA Section 48C is a competitive tax credit that can provide a transferable tax credit of up to 30 of your capital investment in a

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022

Now that we've piqued your interest in 48c Tax Credit Inflation Reduction Act Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of 48c Tax Credit Inflation Reduction Act for various applications.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- The blogs are a vast range of interests, from DIY projects to planning a party.

Maximizing 48c Tax Credit Inflation Reduction Act

Here are some ideas for you to get the best of 48c Tax Credit Inflation Reduction Act:

1. Home Decor

- Print and frame stunning artwork, quotes, or festive decorations to decorate your living areas.

2. Education

- Print free worksheets to reinforce learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

48c Tax Credit Inflation Reduction Act are a treasure trove of innovative and useful resources that can meet the needs of a variety of people and hobbies. Their accessibility and flexibility make them an invaluable addition to both personal and professional life. Explore the vast array that is 48c Tax Credit Inflation Reduction Act today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes they are! You can download and print these files for free.

-

Can I utilize free printables for commercial uses?

- It's based on specific terms of use. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright concerns when using 48c Tax Credit Inflation Reduction Act?

- Some printables may contain restrictions on use. Be sure to review the conditions and terms of use provided by the creator.

-

How can I print 48c Tax Credit Inflation Reduction Act?

- You can print them at home using either a printer at home or in an area print shop for higher quality prints.

-

What program must I use to open printables free of charge?

- The majority of PDF documents are provided in PDF format. These can be opened with free software such as Adobe Reader.

Inflation Reduction Act Of 2022 The Hollander Group

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work

Check more sample of 48c Tax Credit Inflation Reduction Act below

The Inflation Reduction Act And Residential Energy Certasun

How The 179D Deduction Will Change Under The Inflation Reduction Act

Senator Joe Manchin On Twitter I Fought For The Expansion Of The 48C

Machinists Union Pledges Support For Inflation Reduction Act IAMAW

What Small Businesses Should Know About An Inflation Reduction Act Tax

The Inflation Reduction Act Is A Victory For Working People AFL CIO

https://www.irs.gov/credits-deductions/frequently...

The Inflation Reduction Act IRA provided 10 billion in funding for the Qualifying Advanced Energy Project Credit Allocation Program under section 48C e These

https://www.irs.gov/newsroom/qualifying-advanced...

FS 2023 16 June 2023 The Inflation Reduction Act IRA provided 10 billion in funding for the Qualifying Advanced Energy Project Credit Allocation Program under section 48C

The Inflation Reduction Act IRA provided 10 billion in funding for the Qualifying Advanced Energy Project Credit Allocation Program under section 48C e These

FS 2023 16 June 2023 The Inflation Reduction Act IRA provided 10 billion in funding for the Qualifying Advanced Energy Project Credit Allocation Program under section 48C

Machinists Union Pledges Support For Inflation Reduction Act IAMAW

How The 179D Deduction Will Change Under The Inflation Reduction Act

What Small Businesses Should Know About An Inflation Reduction Act Tax

The Inflation Reduction Act Is A Victory For Working People AFL CIO

What s In The 2022 Inflation Reduction Act LaPorte

Inflation Reduction Act Of 2022 Significantly Changes 179D And 45L

Inflation Reduction Act Of 2022 Significantly Changes 179D And 45L

BREAKING DOWN The EV Tax Credit 2022 Inflation Reduction Act 2022