In the age of digital, where screens dominate our lives but the value of tangible printed products hasn't decreased. For educational purposes, creative projects, or simply to add an extra personal touch to your area, 2023 Indiana Child Tax Credit are now an essential resource. This article will take a dive into the sphere of "2023 Indiana Child Tax Credit," exploring the benefits of them, where they are, and how they can be used to enhance different aspects of your life.

Get Latest 2023 Indiana Child Tax Credit Below

2023 Indiana Child Tax Credit

2023 Indiana Child Tax Credit -

The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint filers

Calculate the maximum child credit per taxpayer This is the overall child credit cap 6 000 2 000 x 3 children Same as current law 2 Calculate the maximum amount of the child credit that can be received by low income taxpayers who owe 0 in taxes This is the additional child tax credit ACTC cap 4 800 1 600 x 3 children

2023 Indiana Child Tax Credit encompass a wide array of printable materials online, at no cost. They are available in a variety of designs, including worksheets templates, coloring pages and more. The appeal of printables for free is in their versatility and accessibility.

More of 2023 Indiana Child Tax Credit

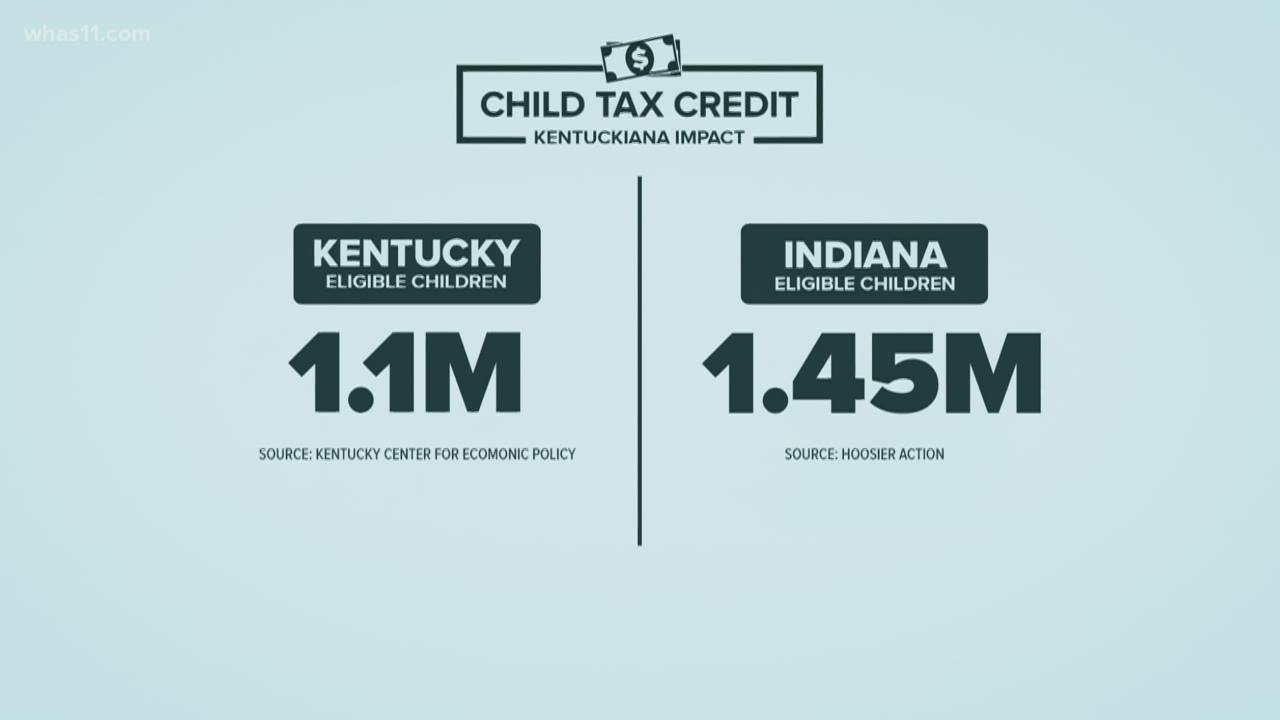

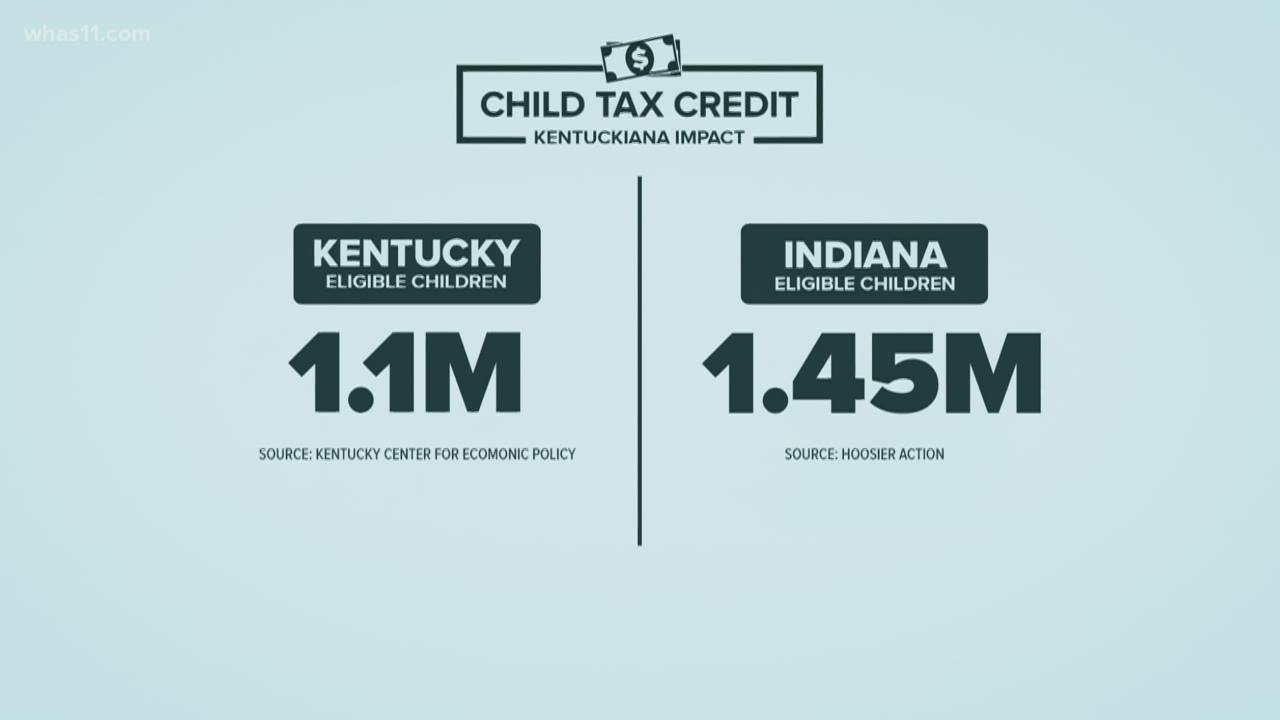

Advanced Child Tax Credit Could Boost Hoosier Spending By More Than

Advanced Child Tax Credit Could Boost Hoosier Spending By More Than

Adoption Credits Indiana s adoption tax credit increases to 20 of the federal adoption credit up from 10 or 2 500 up from 1 000 whichever is less If the credit is claimed for multiple eligible children the credit and limitation is computed separately for each child

Claim a credit based on the repayment amount Example Ryan was a full year Indiana resident in 2018 and received 1 700 unemployment compensation that year He reported the full amount on his 2018 federal and Indiana income tax returns Early in 2019 Ryan found out he had to repay 345 of that compensation he repaid it that June

2023 Indiana Child Tax Credit have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

The ability to customize: It is possible to tailor printed materials to meet your requirements in designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Use: Printables for education that are free can be used by students from all ages, making them a great tool for teachers and parents.

-

The convenience of Access to many designs and templates reduces time and effort.

Where to Find more 2023 Indiana Child Tax Credit

Indiana Child Advocates Demand Action On Renewing Child Tax Credit

Indiana Child Advocates Demand Action On Renewing Child Tax Credit

The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you may receive up to

The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements 1 age 2 relationship 3 support 4 dependent status 5 citizenship 6 length of residency and 7 family income You and or your child must pass all seven to claim this tax credit TABLE OF CONTENTS

Now that we've piqued your interest in printables for free Let's look into where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in 2023 Indiana Child Tax Credit for different applications.

- Explore categories such as furniture, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing, flashcards, and learning materials.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a broad variety of topics, everything from DIY projects to party planning.

Maximizing 2023 Indiana Child Tax Credit

Here are some fresh ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home also in the classes.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

2023 Indiana Child Tax Credit are an abundance of practical and imaginative resources catering to different needs and hobbies. Their accessibility and versatility make them an essential part of both professional and personal lives. Explore the plethora of 2023 Indiana Child Tax Credit now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are 2023 Indiana Child Tax Credit really absolutely free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I utilize free printables for commercial uses?

- It depends on the specific conditions of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright violations with 2023 Indiana Child Tax Credit?

- Some printables may contain restrictions on use. Make sure to read the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home with a printer or visit a local print shop for premium prints.

-

What software is required to open printables free of charge?

- Many printables are offered as PDF files, which can be opened with free software like Adobe Reader.

Tightening Abortion Laws Reignite Conversation Around A Permanent Child

How The Advanced Child Tax Credit Payments Impact Your 2021 Return

Check more sample of 2023 Indiana Child Tax Credit below

How Much Per Child Tax Credit 2022 A2022b

30 Child Tax Credit Worksheet 2019

Hunger Rises Following Expiration Of Child Tax Credit Indiana Capital

2021 Child Tax Credit Advances Payment Schedule Atlanta CPA

Child Tax Credit Explained How Will It Affect Kentucky Indiana

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

https://crsreports.congress.gov/product/pdf/IN/IN12306

Calculate the maximum child credit per taxpayer This is the overall child credit cap 6 000 2 000 x 3 children Same as current law 2 Calculate the maximum amount of the child credit that can be received by low income taxpayers who owe 0 in taxes This is the additional child tax credit ACTC cap 4 800 1 600 x 3 children

https://www.nerdwallet.com/article/taxes/qualify...

Child Tax Credit 2023 2024 What It Is Requirements and How to Claim For 2023 taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that may be refundable

Calculate the maximum child credit per taxpayer This is the overall child credit cap 6 000 2 000 x 3 children Same as current law 2 Calculate the maximum amount of the child credit that can be received by low income taxpayers who owe 0 in taxes This is the additional child tax credit ACTC cap 4 800 1 600 x 3 children

Child Tax Credit 2023 2024 What It Is Requirements and How to Claim For 2023 taxpayers may be eligible for a credit of up to 2 000 and 1 600 of that may be refundable

2021 Child Tax Credit Advances Payment Schedule Atlanta CPA

30 Child Tax Credit Worksheet 2019

Child Tax Credit Explained How Will It Affect Kentucky Indiana

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

Enhanced Child Tax Credit 2022

Can You Stop Child Support From Taking Tax Refund 2021 SHO NEWS

Can You Stop Child Support From Taking Tax Refund 2021 SHO NEWS

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits